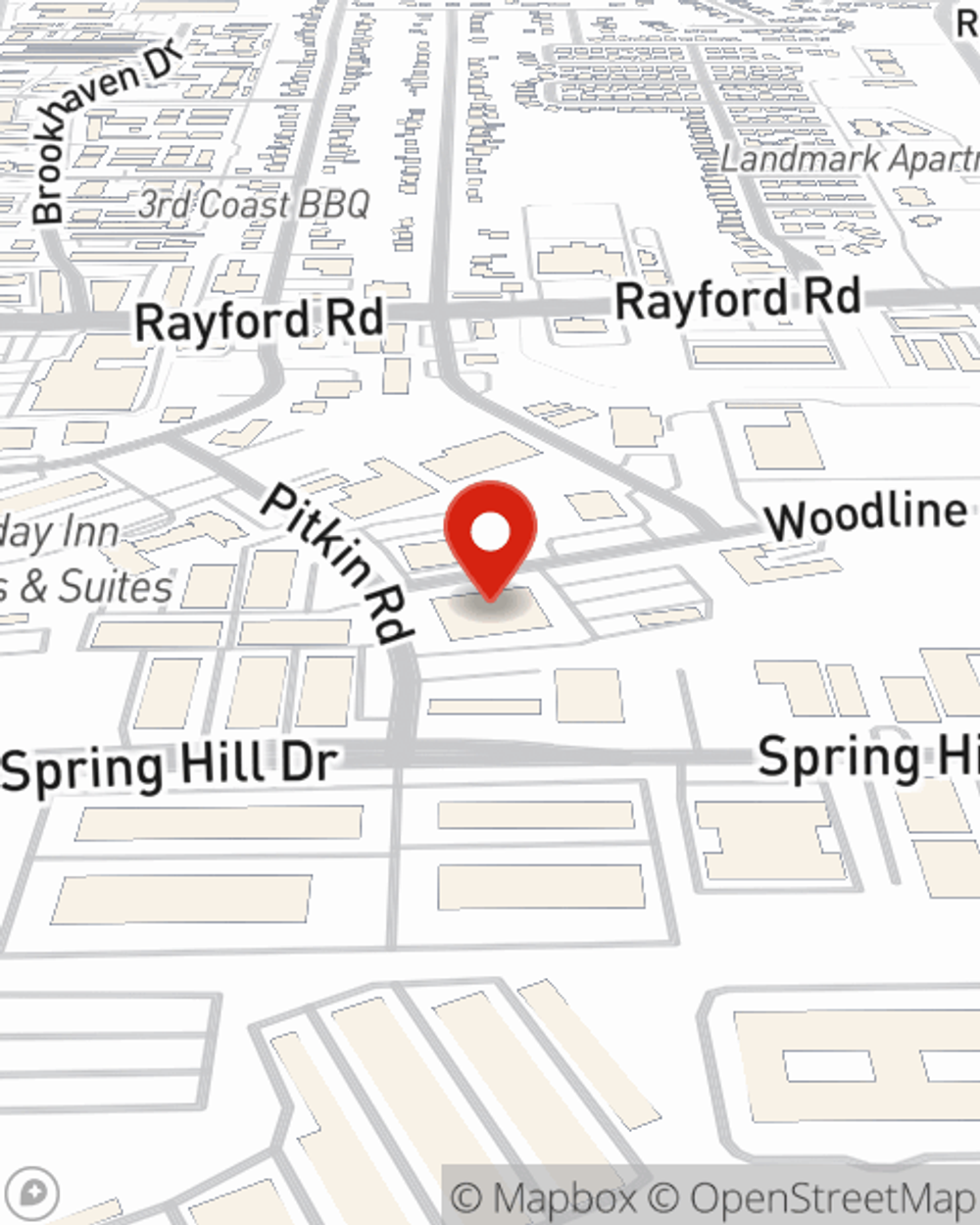

Business Insurance in and around Spring

Looking for coverage for your business? Look no further than State Farm agent Kerry Trigg!

Cover all the bases for your small business

Your Search For Remarkable Small Business Insurance Ends Now.

Owning a business is about more than surviving the daily grind. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for your family. Because you give every effort to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with business continuity plans, worker's compensation for your employees and a surety or fidelity bond.

Looking for coverage for your business? Look no further than State Farm agent Kerry Trigg!

Cover all the bases for your small business

Insurance Designed For Small Business

When you've put so much personal interest in a small business like yours, whether it's a beauty salon, a bakery, or a toy store, having the right insurance for you is important. As a business owner, as well, State Farm agent Kerry Trigg understands and is happy to help with customizing your policy options to fit your needs.

Get right down to business by reaching out to agent Kerry Trigg's team to talk through your options.

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Kerry Trigg

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.